International Fuel Tax Agreement (IFTA) Compliance

IFTA Compliance Made Easy

If you work in multiple states, then you may often move your equipment across state lines from project to project and as result, must comply with government International Fuel Tax Agreement (IFTA) requirements. By knowing where your trucks or vehicles are accumulating IFTA miles by jurisdiction, fuel type and asset you will have the IFTA data you need for your federal fuel tax reporting.

Tenna supports you in the process of calculating fuel tax that you are liable to report to the federal government based on your area of operations. In addition to our standard telematic fleet tracking data from our GPS fleet trackers, we provide automated reports of miles driven per jurisdiction as an added benefit so you and your accounting team can easily pinpoint trip information from your fleet telematics data that can contribute to accurate tax estimates.

This automation improves the old process of manually collecting, analyzing and accounting for how many miles your trucks or vehicles drove by state, region, province, etc.

How IFTA Works

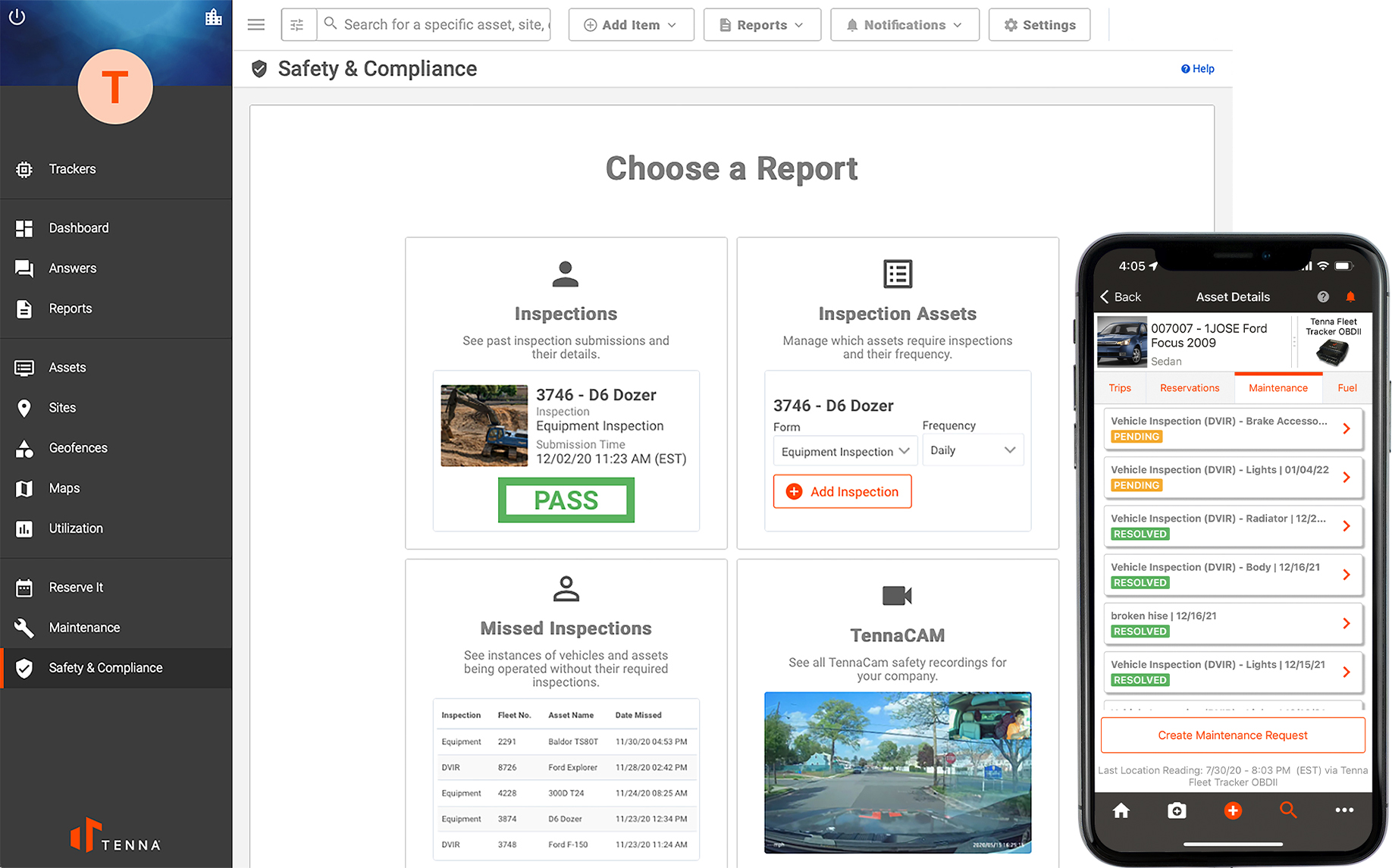

Part of Tenna’s Safety & Compliance package, Tenna translates trip data for IFTA-required vehicles and delivers automated reports on miles driven by jurisdiction for easy analysis.

IFTA is a regulation that contractors must comply with when operating trucks and vehicles in multiple jurisdictions outside of their “base state” for tax reporting, calculated based on miles and fuel costs in states or provinces that drivers of “IFTA-qualified motor vehicles” have entered.

Leverage telematics data you are already getting from your trucks and vehicles to effortlessly automate IFTA compliance while reducing human error.

Work with accurate data to submit accurate tax amounts and avoid over or underpaying.

Safety & Compliance

Maintain compliance and support for audits by analyzing trips taken by trucks and vehicles with IFTA reporting requirements to determine the IFTA miles driven by jurisdiction. Classify assets as IFTA-compliant or not.

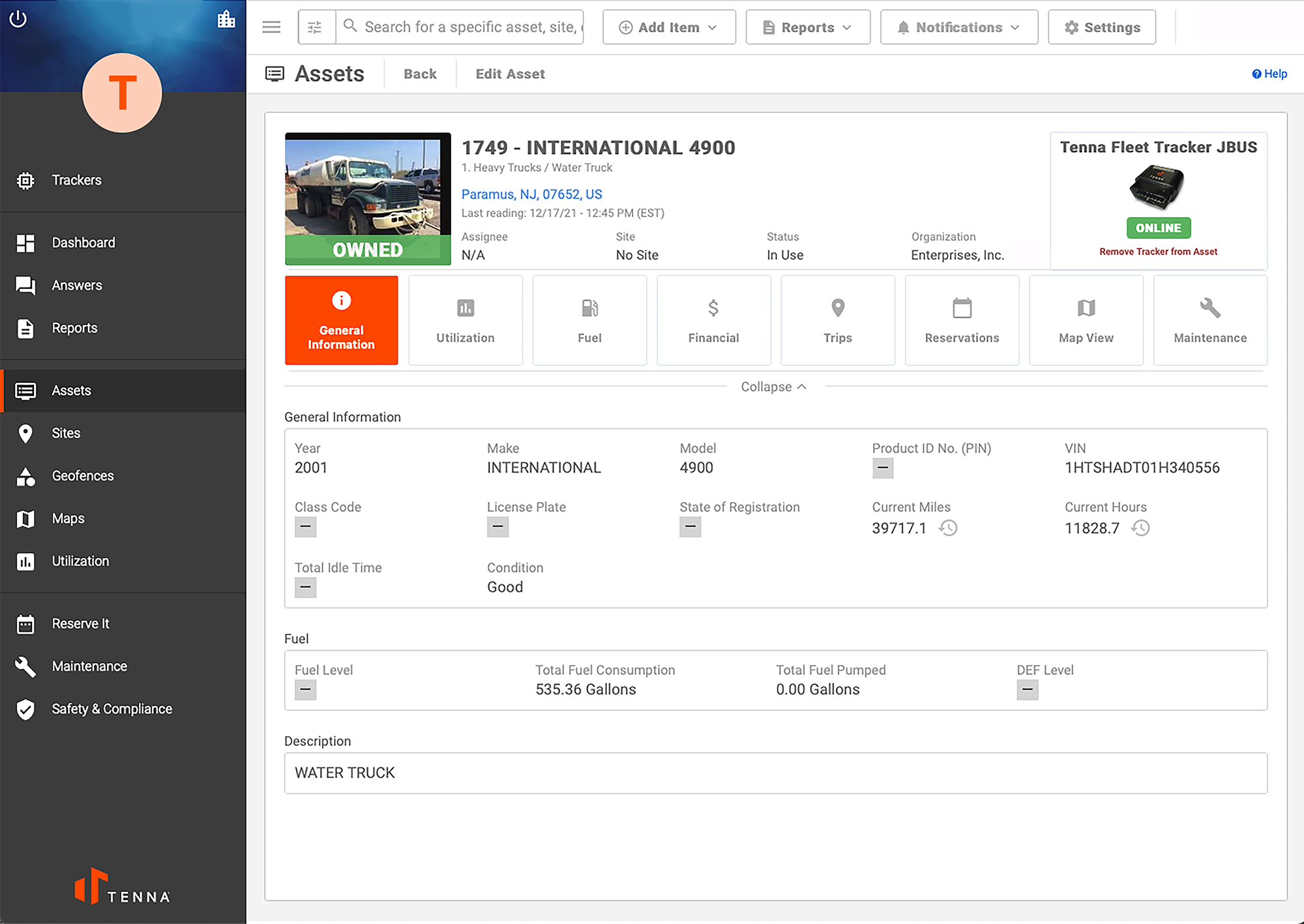

Assets

Attribute and designate assets that require IFTA compliance and filter your asset list to find these easily. Miles are accurately recorded on a trip by trip basis using data your GPS fleet trackers are already collecting for your trucks and vehicles.

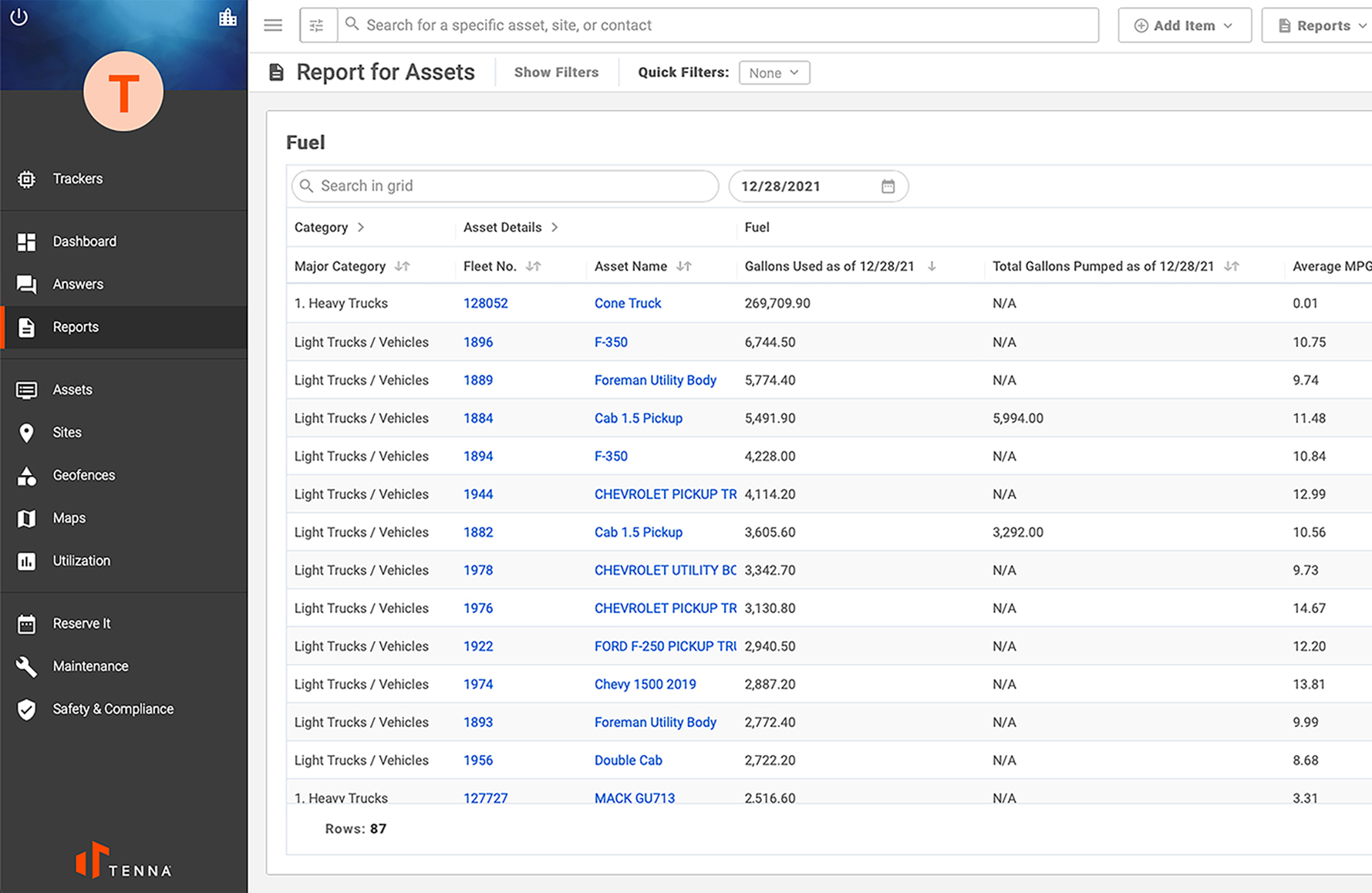

Reports

Manage IFTA miles (vs. non-IFTA miles) driven by automatically accumulating and reporting on miles at the end of each quarter. Tenna delivers consolidated reports of IFTA miles driven by vehicle, fuel type or jurisdiction for analyzing data the most relevant way for you to report for full compliance.

Benefits of Tenna’s IFTA Compliance Feature

Increased Compliance and Safety

- Increase visibility

- Improved communication and data sharing for accounting

- Reduces human error

Better Business

- Reduce risk of misreporting or non-compliance

- Improve data analysis

- Improve record keeping and documentation

IFTA Product Overview

Visualize Your Fleet in Action

Book a Demo