IFTA Fuel Tax Software Built for Construction Fleets

Simplify IFTA Compliance and Reduce Administrative Burden

Managing fuel tax reporting across multiple jurisdictions can be time-consuming, error-prone, and stressful—especially for construction companies operating mixed fleets across state or provincial lines.

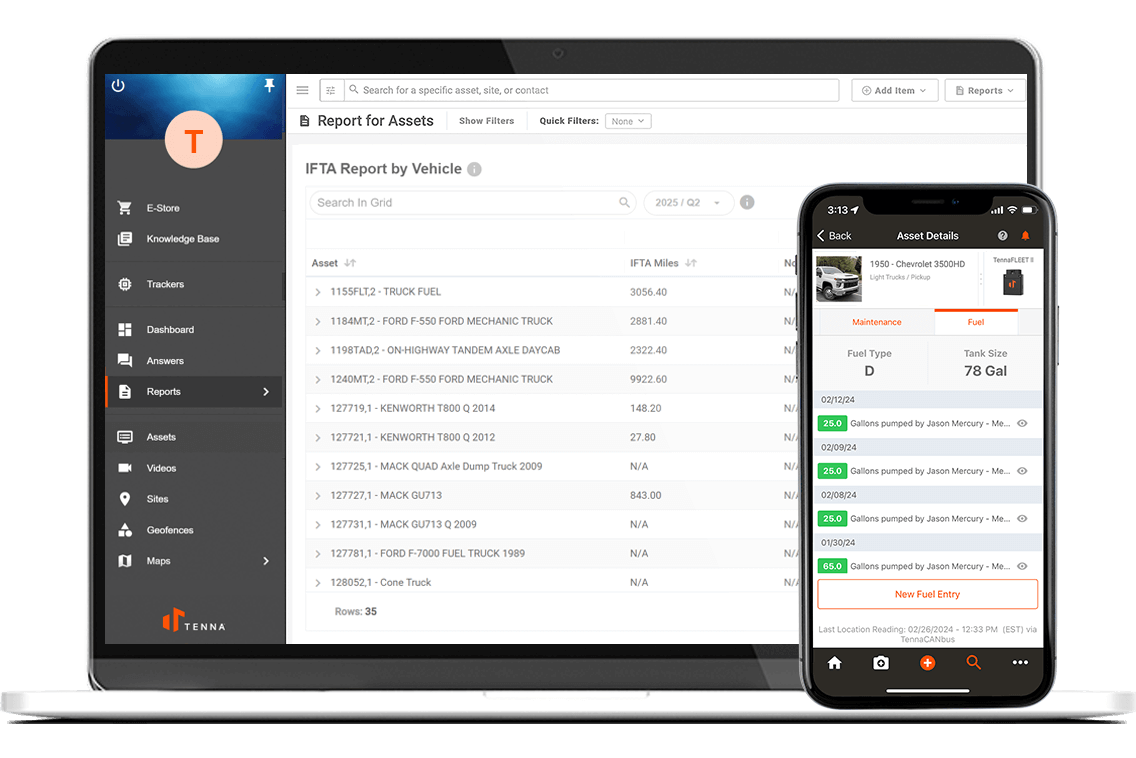

Tenna’s IFTA fuel tax software makes IFTA compliance easy and automatic for accounting teams by tracking fuel usage, mileage, and jurisdictional travel in real-time.

- Eliminate the need for manual reporting and logbooks.

- Get precise GPS tracking and fuel data capture.

- Save time with automated jurisdictional calculations and downloadable reports.

- Keep your operation compliant and audit ready.

Tenna’s IFTA Fuel Tax Software for Construction Fleets

Tenna’s IFTA solution is built directly within its fleet management platform designed specifically for the construction industry. It goes far beyond generic fleet compliance tools to automate complex tracking, reporting, and jurisdictional analysis. Tenna’s platform eliminates errors with automated GPS data, reduces administrative time, and provides clarity across your operations.

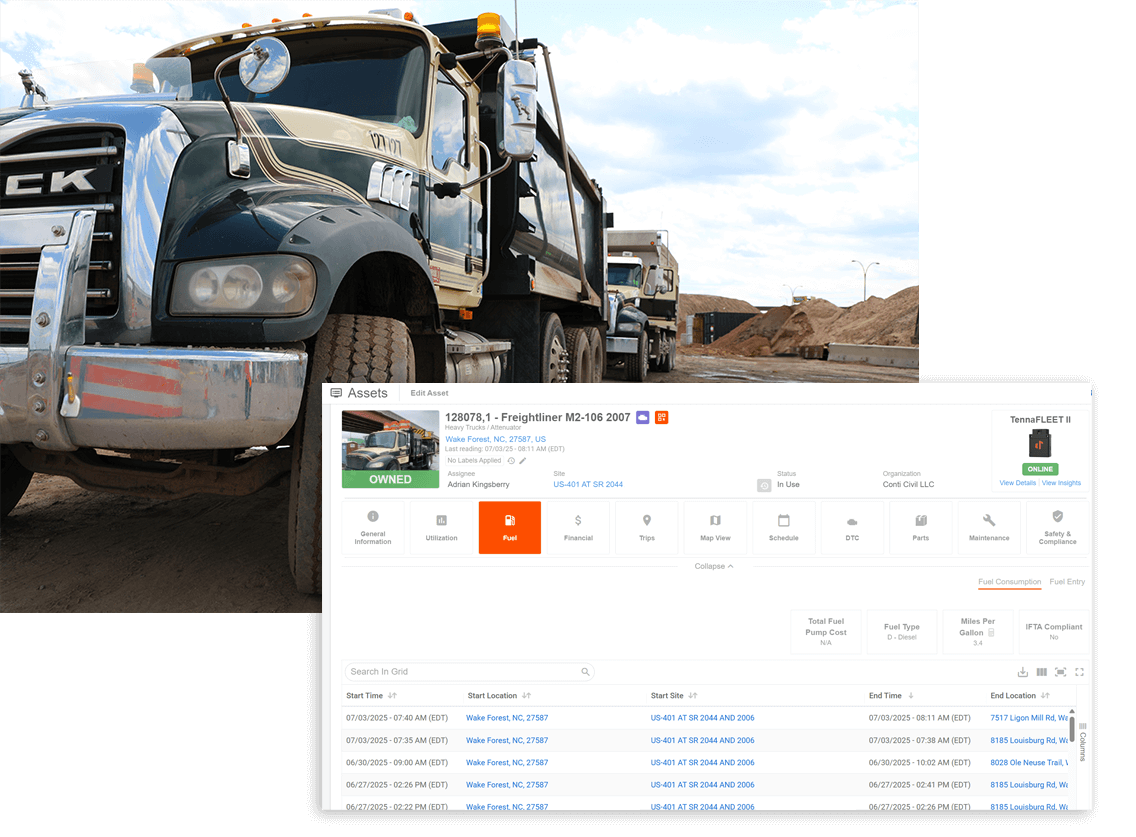

Tenna uses GPS data to track your vehicle’s mileage in each state or province. No driver input is needed. This ensures precise, audit-ready data for IFTA reporting.

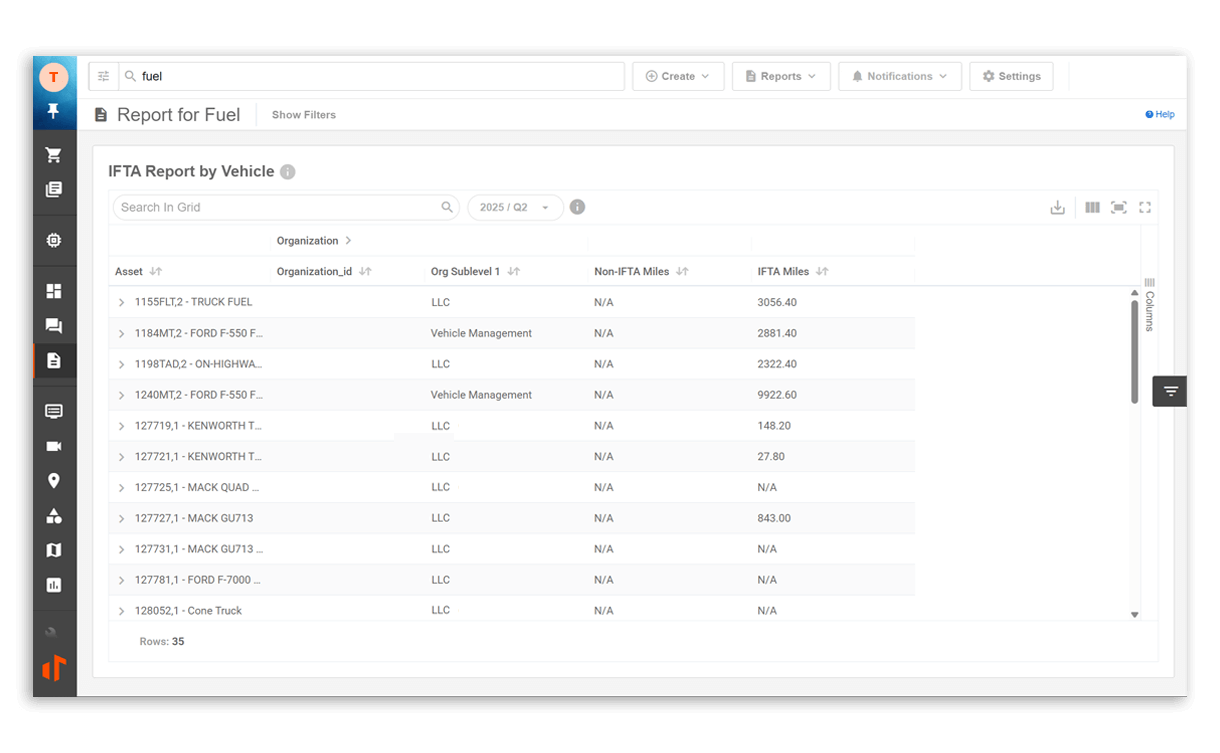

Generate pre-formatted IFTA reports for each jurisdiction with just a few clicks. Tenna’s system compiles all mileage and fuel data and prepares submission-ready documentation.

Manage all IFTA-related data—miles, gallons, jurisdictions, and purchase history—in one centralized platform. No more hunting through spreadsheets or relying on driver memory to get your accountants the documentation they need.

See where your vehicles are traveling, how much fuel they’re using, and which jurisdictions they’re active in—all in real-time. Spot discrepancies or compliance gaps before they become costly issues.

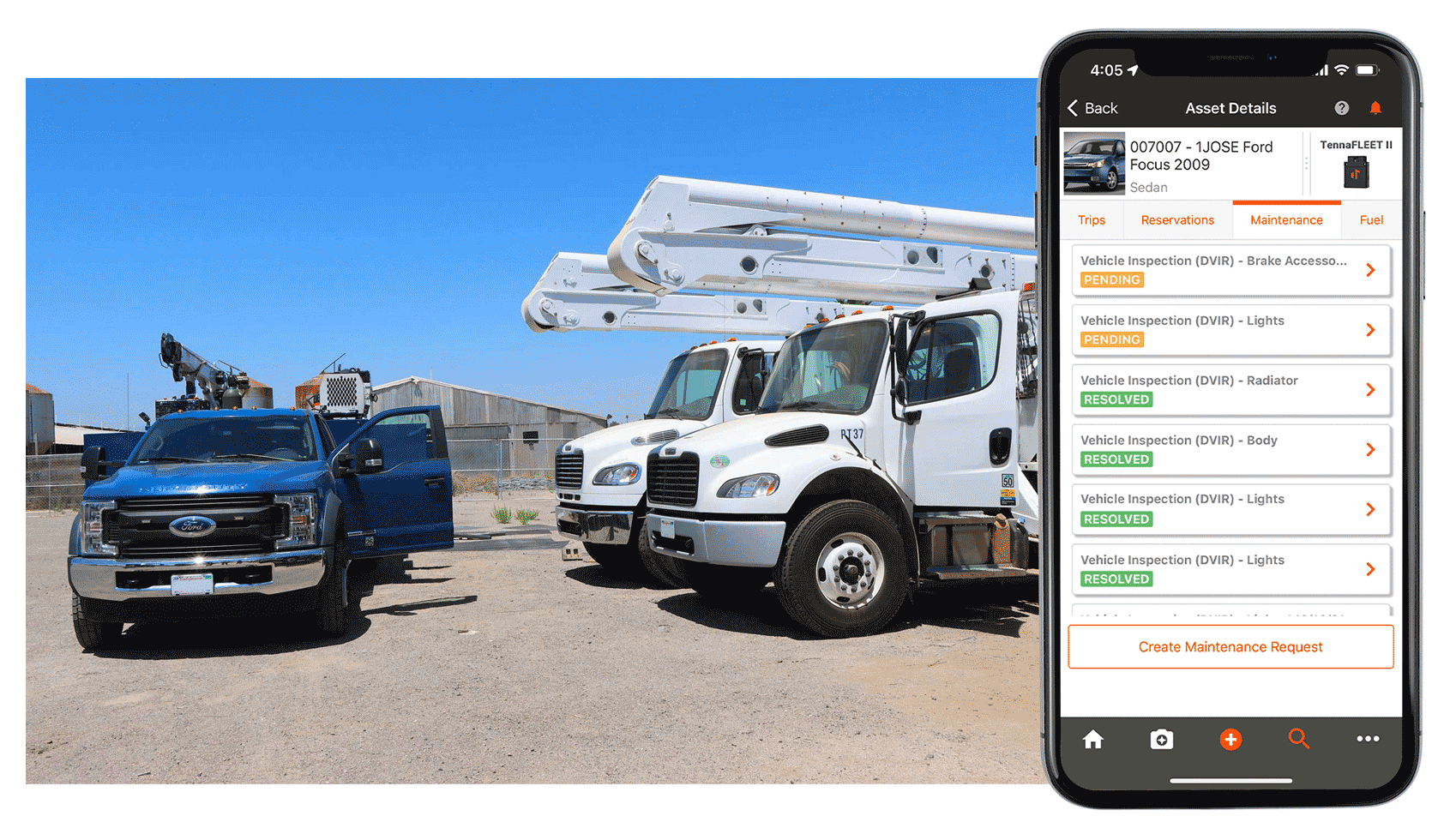

Tenna’s IFTA fuel tax software is built directly within its telematics, DVIR, maintenance, and safety system, so your fleet compliance and management is holistic, not fragmented.

“With Tenna, we can quantify the fuel amount and stay up to date with our field tracking reports. When customers rent units, it makes it much easier for us to go back in and charge the appropriate customers any fuel surcharges or taxes. Tenna took a very laborious job and turned it into a click. We can pull the reports and fast track that process.”

- Environmental Products Group

Why Choose Tenna for IFTA Compliance

Built for Mixed Fleets

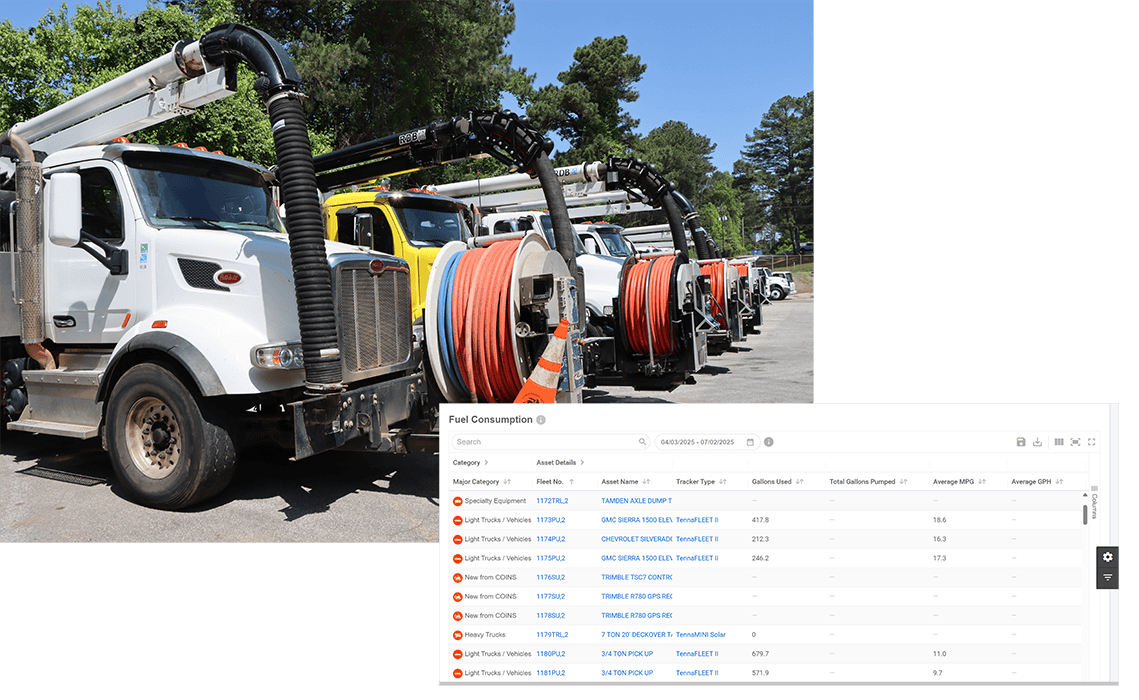

Whether you're operating dump trucks, fuel haulers, service vans, or lowboys, Tenna tracks jurisdictional mileage accurately across all vehicle types on the same platform you manage the rest of your mixed fleet.

Scalable for Growing Fleets

As your operations expand across state lines, Tenna grows with you, tracking fuel tax compliance seamlessly as your fleet footprint evolves.

Reduce Manual Errors and Admin Time

Free your equipment management and accounting teams from the burdens of compiling fuel logs and calculating tax liability. Let Tenna do the work accurately and automatically.

Audit-Ready Reporting

Avoid penalties and pass IFTA audits with confidence. Tenna’s software backs your reports with time-stamped, GPS-verified data.

Improve Cost Recovery

Understand where and how your fuel is consumed. Tenna’s visibility into jurisdictional fuel use helps ensure proper reimbursement and internal accountability.

How It Works

1. Track Mileage & Fuel Use Automatically

Vehicles equipped with Tenna’s GPS tracking devices record mileage and fuel consumption in real time and automatically assign miles to jurisdictions. Drivers can also manually add gallons pumped at time of purchase to Tenna app.

2. Generate Reports

Tenna calculates your quarterly tax liability and generates IFTA-compliant reports, simplifying submission.

3. Stay Compliant

Receive alerts and maintain a digital paper trail to ensure you’re always ready for audits or regulatory reviews.

Want to learn more about key IFTA requirements as well as the consequences of non-compliance? Check out this article about how fleet software can help contractors maintain IFTA compliance.

Tired of manual reporting?

Learn more about how you can improve safety and streamline inspections across your construction fleet

Frequently Asked Questions

Carriers must track miles driven and fuel purchased in each jurisdiction. Reports are submitted quarterly, and taxes are calculated based on where the fuel was used—not purchased.

Tenna uses GPS and telematics to track where each vehicle goes and how far it travels. It assigns miles to the correct states and provinces.

Yes. Tenna compiles your fleet utilization and fuel data and generates complete, accurate IFTA tax reports each quarter, ready for review and submission.

Visualize Your Fleet in Action

Book a Demo